Discounts may reach up to 70% upon meeting certain requirements

On October 18, 2024, Brazil’s Attorney General's Office (AGU) published the transaction notice regulating the adherence to the extraordinary debt settlement program for debts owed to federal autarchies and public foundations of a non-tax nature, under Federal Law No. 14.973/2024 and Normative Ordinance No. 150.

Adherence to the Program

The period for joining the program is from October 21 to December 31, 2024, through completing and submitting an electronic form on the AGU platform.

The Debt Settlement Program allows taxpayers to settle non-tax debts (débitos em dívida ativa) under advantageous terms, including options for installment payments and discounts ranging from 5% to 70%, based on specific conditions.

Eligible Credits

Eligible credits include those registered in the debt roster of federal agencies and foundations by Brazil’s Attorney General's Office, including credits subject to collection in tax enforcement, discussed in lawsuits or arbitration processes, included in previously terminated installments, or with enforceability suspended. This means that debts whose enforceability is suspended due to fines imposed in administrative sanctioning proceedings, for example, by CADE (Antitrust Authority), INMETRO (Certifying Organ), ANP (Oil & Gas Agency), ANTT (Brazilian National Agency for Surface Transportation), and other agencies, are covered.

Discounts

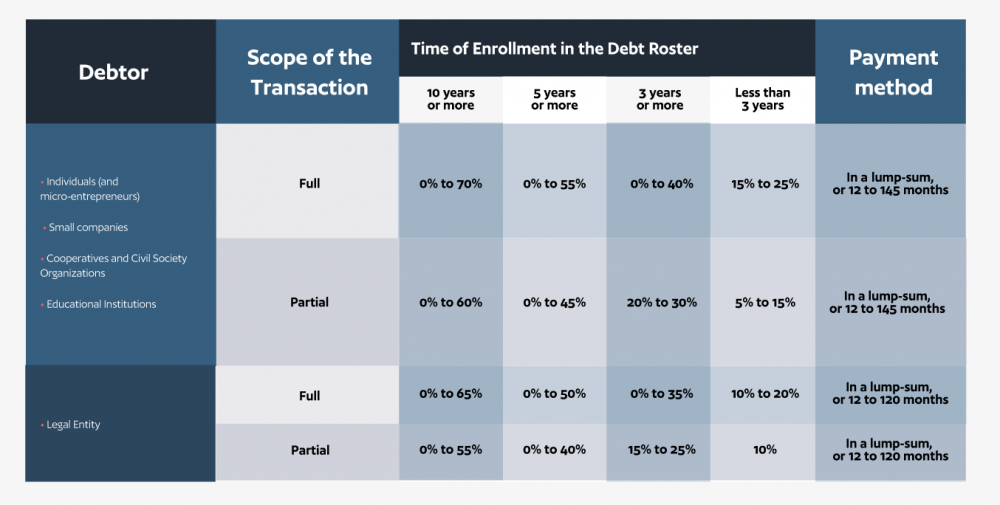

Participation in the program involves a significant discount of up to 70% on the total amount of the credit, including interest, fines, and legal charges. The applicable discount rate will depend on several criteria, such as the length of registration in active debt (or duration of the judicial action/arbitration proceeding), the type and category of the debtor, as well as the scope of the agreement (whether it includes all debts or only a portion of it), as per the table below, also available here (in Portuguese).

Payment Options

Payments can be made in full or in installments of up to 145 months, depending on the debtor's profile.

Key Considerations

Participation in the program requires an irrevocable confession of the credits covered by the settlement. When there is already a judicial or arbitration discussion, it will be conditional upon the waiver of the claims made.

At TozziniFreire, we have been addressing this topic in a multidisciplinary manner, considering all aspects involved. Our Litigation, Antitrust, and Administrative Law teams are ready to guide companies in seeking efficient solutions for their debts with regulatory agencies, autarchies, and federal foundations.

For more information or assistance, please feel free to contact us.